Many Nebraska communities are not only dealing with the effects of high water, hail, and tornadoes this spring; they may also be facing higher property insurance rates as insurance companies struggle to keep up with the increased number and size of property claims submitted nationally.

Embry Nichols, insurance specialist with Guy Carpenter and Company, recently told the League of Association of Risk Management (LARM) staff and two members of the LARM Board that there may be property insurance rate increases in the near future. Guy Carpenter and Company represents LARM as a reinsurance intermediary to help mitigate risk by securing additional financial protection from the global commercial insurance market.

“The public entity property market has changed significantly in the last quarter. Pools and their members will be facing rate increases driven by both catastrophic (wind, hail and flood) and attritional (non-catastrophe losses such as fires),” Nichols said.

She said the 2017 and 2018 hurricane seasons brought a significant level of insured and economic loss across the US and that “the last two years now rank the highest of all time in terms of economic loss.”

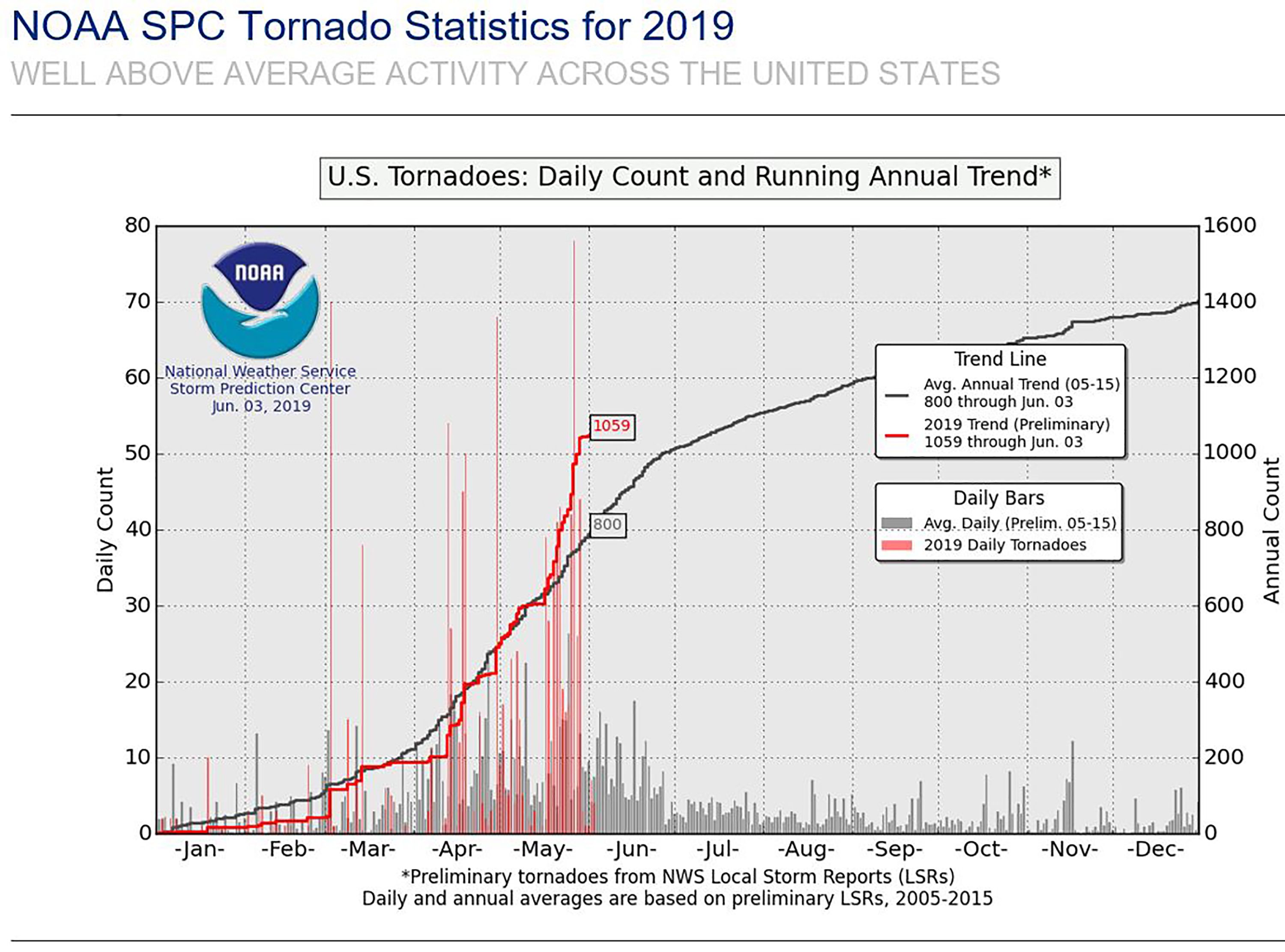

“Rising losses have led to a shift in the underwriting process from account-specific underwriter judgment to reliance on computer assisted modeling. The data from these computer models along with the continuing Midwest flooding, increased tornadic activity, melting snow pack from the Rockies and currently rising Missouri and Platte Rivers, is causing reinsurers to slow down and take a longer, closer look at pricing and terms,” Nichols said.

Fortunately, the possible increase in property rates may be balanced out with lower equipment breakdown insurance rates.

“On the upside, property coverages are being expanded and equipment breakdown programs are seeing rate decreases along with expanded coverages and services,” Nichols said.

Lane Danielzuk, LARM Board Vice-Chair, said Nichols’ comments would be useful for LARM as it goes into the time of year for premium setting.

“Determining the amount of premiums is a complicated process and the amount of risk gauged by our reinsurance partners is a vital component of that pricing,” Danielzuk said.